-

What are the goals of a Christian financial education program?

It’s helping people find financial freedom using biblical standards of financial stewardship. We teach these topics: Biblical contentment; careful use of resources; planning for spending and saving; spending decisions (budgeting); giving; debt; saving; investing and/or long-range goals

-

How do we know if we need such a program?

See Church Finance Questions (pdf) for a set of questions that may assist a church in answering this question.

- Determine the interest. It will come primarily from Christians.

- Determine your goals. Getting out of financial bondage may be sufficient motivation for those inside the church. For those outside, try to tie the program into an immediate benefit—eg, an Individual Development Account or as a qualification for home ownership, as with the HOPE VI Home Ownership program. Lacking this, a financial crisis or court order will suffice for motivation. Certainly those who keep returning to a church for help are candidates, if they wish to continue to receive assistance, although coercion doesn’t work well.

-

What help is available?

- For those inside your church check Crown Ministries www.Crown.org for a wide range of resources.

- For the poor outside the church, materials are available from New Focus National http://www.newfocus.org/

- A curriculum has also been developed by The Bethlehem Center www.thebeth.org and another by LoveInc, a program of World Vision. You may need to supplement or develop your own materials, based upon local considerations and conditions.

- How do I locate qualified teachers? www.Crown.org local counselors can probably give assistance in identifying local financial teachers and counselors. You could also train church members via resources at Crown Ministries and other programs such as the Chalmers Center www.Chalmers.org

- It’s generally better to have same-ethnic-group teachers.

- Provide clear written expectations for attendance and any other requirements and clearly state any incentives. Having people stay with a program is often a problem. For those outside the church you may experience:

- Transportation problems

- Trouble keeping appointments

- Problems due to lack of permanent addresses

- Problems of communication—not having a reliable telephone number or address

- Discouragement

- Dealing with those who are trying to get whatever they can—extremely self-centered and exploitative persons.

- Visit successful model programs. Many try to develop a model, but does it actually work?

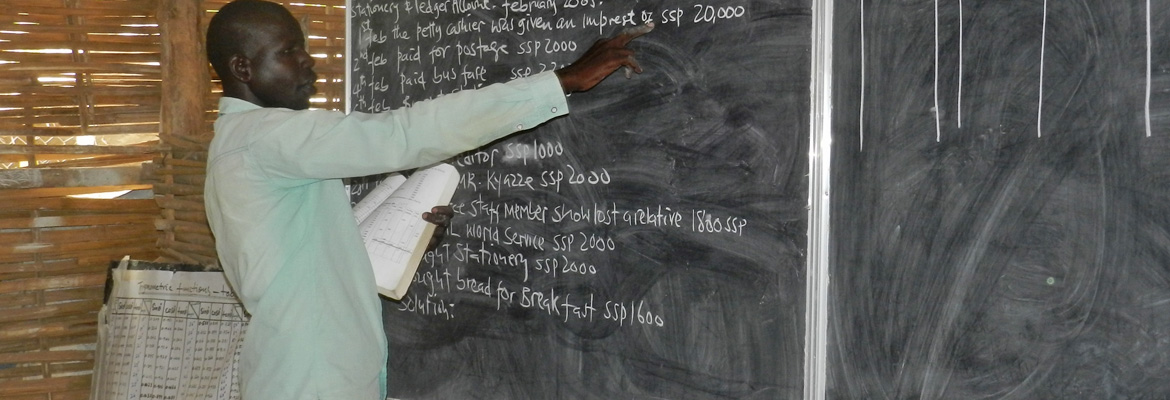

- Instructional structures:

- Class: 10-12 weeks of meeting 10-12 times, including Sunday School quarters, with a live teacher or moderator;

- Crown has a “Treasure Principle Workshop ” small group study via VHS/DVD Small groups;

- Crown small group (10 weeks, meetings weekly) ;

- Seminar model of 1-2 days

- Individual mentoring, where an appointment is made with a budget debt/counselor.

- When someone is forced to participate in order to get some benefit—there is a sense of coercion. People must want to belong to the program for it to have significant benefit.

-

How can we minister to the poor?

The best SES lift program in the world is the Gospel. New Christians normally experience economic lift. They want to work, have more desire to save and provide for their family and are less inclined to spend on drink, drugs and gambling. The best economic program you can offer is the chance to be reconciled to God. From there, if they seek first God and His kingdom, their basic needs will be met (Matt. 6:33).

The best place for growth is a solid, biblically-based church. Financial success depends upon self-control. The Holy Spirit gives self-control (Gal. 5:23). The natural tendency is to spend upon our pleasures, and go far beyond our income, borrowing for our pleasures and wants. Therefore, Christianity is the best foundation for financial training, since the Bible gives clear guidance for financial stewardship, with clear warnings against greed and the desire to get rich (1 Tim. 6:9-10). It is a balanced approach to the acquisition and use of money. Judaism also is correlated to higher SES, and it shares with Christianity the Old Testament perspective upon wealth, especially as found in Proverbs. The Bible speaks much about giving, which, outside the family, is completely unnatural.

The rich (we) are commanded to “do good, to be rich in good deeds, and to be generous and willing to share.” (1 Tim. 6:18).

-

How do you cross the Social Economic Status (SES) divide?

We cannot cross it. The power of God alone can do this. It’s beyond us, but well within the possibility of the Holy Spirit.Those dealing with the poor need to remember that each person is made in God’s image (Gen. 1:26). We’re commanded to love (1 John 4:7) and to consider others more important than ourselves (Phil. 2:3). We aren’t to show favoritism toward the rich (James 2:1-9). Incidentally, if you make $10,000 you are among the upper 10% of income globally.{footnote}World Christian Encyclopedia, David Barrett, George Kurian, Todd Johnson, Eds. 2001, ISBN:0195079639, p. 1:6{/footnote}

Spend time with the people where they live. Focus upon what is important to them. For example, I was surprised that young men in the inner city of Chattanooga, TN often really want to find a job. Total strangers would drop everything and immediately get into my car to visit places that would help them find work. Therefore, I developed a list of job agencies and programs for ex-offenders and a current list of job websites relating to the local community. I also sometimes take them to employers with whom I have a relationship, when there is a job opening. You can become closer to people by being there when no one else is. Visit them in jail, for example. I’ve gotten closer to guys on the street than their closest friends, simply by visiting them in jail, when none of their friends did. This crosses the divide.

-

How do we train trainers?

I generally refer those interested in debt/budget counseling to the Budget Counselor Training Course offered by Crown Ministries. I’m not aware of any comparable training.

People identify themselves as potential counselors or teachers, in my experience, by expressing how they would like to help those struggling with finances in their church. On two occasions, they were former counselees who either got extra training, or who simply started mentoring others (counselors must not use this ministry to sell their own products). Others have expressed a desire for a financial counseling ministry after a seminar. Those who have achieved financial freedom could be approached as potential counselors.

-

What’s it like for an older white man to mentor a black man?

Humility is crucial. If there is condescension, that will become quickly apparent (Phil. 2:1-11). The friend must want to be mentored—otherwise, he will avoid you. You need to be very flexible. The person might not show up or might have another agenda and are using you to get what he or she wants. There needs to be acceptance, but with boundaries. I worked with a young man for some months, got him a job and had Bible study with him. He later admitted that he lied to get money from me. I’d arranged to take him to a weekend retreat for African American men, all expenses paid, to which he agreed. The Friday we were planning to leave he called and asked if I could help him move some things. I arranged to do this just before we left for the retreat. When I met him I discovered as we drove that he wanted me to help him move back into his girlfriend’s apartment and he backed out of the retreat. I helped him move, but told him to call me when he was serious about following the Lord. About 4 months later, he called and we had fellowship again and Bible study. He sounded like he was serious again about following God.

Consistency is important. They need to be able to rely upon what you say. You must overcome much suspicion as to what your real motives might be. Of course, you don’t dress in a tie and jacket in the inner city. You try to dress as they dress, within reason. You also need to be above reproach interacting with women.

-

Experiences I’ve had in financial mentoring

Most people don’t want to be on a budget. They think that they don’t make enough money and that whatever does come in, must go for an immediate need or emergency. In some way, they think they are exceptions. With some there is little follow-through and budgets are fairly irrelevant. Spending is done on the fly. Budgeting is seen as more of an impediment to life, than a solution.

In working with the very poor, it’s difficult to consistently meet with a person, even if you go to their home. Getting together is very difficult if there is no phone.

If someone really wants help, they will follow your counsel and continue to keep appointments. If not, they will avoid you. If a person has hit the bottom of the financial ladder and cares, he or she is a prime candidate for help. This person will do everything you suggest, for as long as necessary.

Encouraging unemployed young men and women to get training from agencies in order to get a job is a hard sell. Young men generally do not want to invest even 4 weeks in a job training program to get a better job—preferring to work for a temporary agency immediately. Even when they haven’t gotten a job for perhaps 6 weeks, they don’t want to spend time training. They want money now. Computer skills are lacking among many inner city dwellers, such that many don’t know how to get to a website. But most know of someone who can.

-

What I’ve learned from counseling

Over-spending is probably the biggest problem, followed by inadequate income. Both are often spiritual issues of lack of self discipline. Over-spending is found in these particular areas:

- Spending over 40% of net spendable income (gross income, less taxes and giving) for housing & utilities

- Long distance/cell phone bills too high Tip: use www.OneSuite.com

- Clothing expenses too high

- Paying too much for auto insurance or having no insurance at all

- High debt load and failure to even list and total all debt - Tip:The Debt List (pdf)

- Going to Cash Advance or Check Advance (usury) stores

- Rent-to-own, instead of save-to-own

- Little or no savings—failure to plan for future needs and goals

- “Miscellaneous” spending out-of-control

- Little giving to Christian causes & too much giving to relatives

Upper SES issues:

- Inability to pay for private schooling

- Pleasure tab—large bills for cable, gyms, trips, vacations

- Over-spending for food, and dining out, and for cell phones

- Inadequate or over-adequate retirement, in light of debt load

- Failure to establish long-term savings goals for college and retirement and becoming debt-free, particularly.

- Little or no cash savings