A budget is a spending plan created so that (1 spending reflects the church’s highest priorities (2 spending is not simply in response to immediate needs, but has overall perspective (3 either a shortfall or an overage can be wisely used, according to a carefully predetermined spending plan (4 all important areas of funding are included, both short and long-term. This plan is most appropriate for a church beginning to budget her income. To better understand your church’s giving and uncover financial ministry opportunities in your church, see the stewardship inventory.

Priorities for Funds

- What are the church’s ministry priorities, according to the New Testament?

- What is the church’s mission statement?

- What is the church’s vision?

- Do the current financial expenditures reflect the mission and specific vision of our church?

- A grouping into departments and an analysis of spending should be done.

- Examples of departments would be: Church staff; Christian Education and Music; Facilities and Transportation; Community ministries; Global ministries; Church Administration (including various Boards)

- What percentage of total income does each department use?

- What are our specific local priorities?

- What is the order of priority of those ministries (most important to least important).

- What are the short-term goals of the church (12 months)?

- How much will those goals cost annually (and per month)?

- What are the longer-term goals of the church (over 1 year)?

- How much will those goals cost?

- How much will those goals cost for each of the next five years, per year?

- Which goals might have to be deferred if there is a shortfall, or what new goals will be developed if there is a surplus of funds?

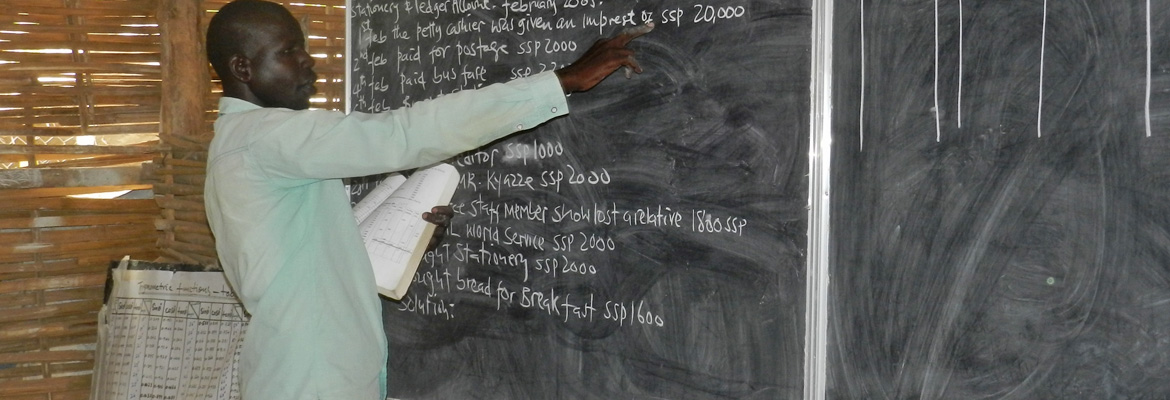

Mechanics of Budgeting

- What are the major categories of church expenditures (departments)?

- Who is responsible for requesting funding for each of these categories?

- Before the fiscal year begins, requests should be received from each of the major departments. The request should be supported by estimated costs for items within that department (line items). each year the budget for each department begins at $0, and the budget justified for the new year. An automatic increase should not be expected in any category or department.

- Who handles the church finances, and directs funds to the departments?

- Who monitors the church’s finances?

- Who has the final decision-making power in budget/financial decisions? Ideally, this would be the deacons, since they are given oversight of church finances.

-

(Acts 72 So the Twelve gathered all the disciples together and said, "It would not be right for us to neglect the ministry of the word of God in order to wait on tables. 3 Brothers, choose seven men from among you who are known to be full of the Spirit and wisdom. We will turn this responsibility over to them 4 and will give our attention to prayer and the ministry of the word." NIV)

- What church software will be used to track finances, and will this software be powerful enough and widely available?

- Does the financial software need to be integrated with an overall church member database?

- An inexpensive program for churches is “The Power Church Plus” program. Currently this program costs about $410.00 for a new user and information is available at 800-486-1800 www.Powerchurch.com

- A sophisticated church management system is produced by Shelby Systems, and costs between $795.00 and $7,500.00, depending upon the modules purchased. More information is available at 800-877-0222 https://www.shelbysystems.com/

- If the church does not need to integrate a membership database with financial software yet, “Quick Books,” by Intuit, is a comparatively inexpensive double-entry system that can be customized for church needs. It has good payroll tracking and account reconciliation features. https://quickbooks.intuit.com/

- Who will have access to these figures and who will not have such access?

- Will others be able to step in easily into this program when the treasurer cannot or if the treasurer changes?

- Does the financial software need to be integrated with an overall church member database?

- How will funds be raised? Will the church rely upon regular gifts from the congregation?

- How will funds NOT be raised?

- Is the method of collecting funds biblical (secret, not under compulsion, or are people pressured to give)?

- What will happen if insufficient funds are received—what are the ordered priorities?

Safety Measures

- What checks and balances do we have in place to prevent mismanagement of funds?

- For example, are two signatures required for expenditures over a certain amount?

- Are two people present when counting the funds?

- Is the deposit ticket checked against the amount counted?

- Are the books audited annually?

- Will a bond be required for the treasurer (paid for by the church)? Church embezzlement happens.

- Are terms for financial officers limited?

Teaching

- Is the church adequately being taught the principles of biblical stewardship, and does the church’s giving reflect their understanding of those biblical principles?

- If so, commend the Church.

- If not, teach and exhort the Church.

- What strategies will we use to teach biblical financial stewardship principles?

- Various forms of resources are available:

- Library books (many available from Crown Financial Ministries)--Crown materials can be ordered by calling 1-800-722-1976 or see www.Crown.org

- Small group studies from Crown Ministries

- Sunday school materials from Crown Ministries

- Seminars (Crown, and Reconciliation Ministries Network 423-822-1091).

- For help in church administration, there is Business Management for the Local Church, by David Pollock, and The Debt-free Church, by Berg and Burgess, also available from Crown.

- What reporting is done to the congregation as to how funds are spent, and what progress reports given on the progress of giving?

Typical Budget Problem Areas

- Pastor’s salary. Has the pastor (and staff, if any) submitted a detailed budget, outlining needs?

- Has the staff budget been evaluated and a satisfactory salary determined, with all benefits calculated in the determination? Is there an automatic annual review of staff salary? Since many pastors will not ask for a raise if they need one, an annual review mechanism should be in place.

- Will the church rely upon special events to raise staff salaries, or upon regular contributions, or both? Does the church need to rely upon special events—or indeed should it?

- Are federal and state taxes properly withheld (W-2 [with W-3], W-4, monthly/quarterly payroll tax, Form 941, form 1099 for contractors who have received over $600.00 in a fiscal year)? Form 990, although designed for a 501-c-3 organization receiving over $25,000 annually, does not have to be filed by a church. Please consult a tax professional for counsel in tax matters.

- Does the Board annually determine a portion of the pastor’s income be designated as “Parsonage Allowance,” which is taxed on FICA, but not on FIT?

- Does the church have a pension plan, such as a 403 (b) plan or a reimbursed medical expenses plan?

- Does the church have in place a system to report, review and reimburse ministry expenses in an orderly and timely way?

- Giving to global missions, compared with spending for the local church’s maintenance.

- What percentage of gross income does the church give to ministry locally?

- What percentage of gross income is spent in Gospel ministry to evangelize and plant churches among pagans elsewhere on the globe (Matt. 28:18-20)?

Other Issues

- How much reserve does the church need for emergencies? Is this funded yet?

- Is the church adequately insured by a reputable agency and insurer?

- What will be the churches position on going into debt as a church? How quickly can thechurch become debt-free, if it is not?